Refundable tax credits, such as the Earned Income Tax Credit (EITC), can not only reduce your tax bill but also turn a bill into a refund. A $700 refundable tax credit would turn your $600 bill into a $100 tax refund. High earners, defined as those making Estimated Tax $150,000 or more if single or married filing jointly ($75,000 if married filing separately), should pay 110 percent of last year’s tax liability to meet safe harbor rules. Normally, penalties and interest apply for underpayments and late payments.

TURBOTAX ONLINE/MOBILE PRICING:

- Federal and state taxes are different, with federal taxes covering nationwide programs and services, while state taxes fund state-specific needs.

- This can help you plan your finances better, whether it’s setting aside money if you owe taxes or planning how to use a potential refund.

- Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

- We believe everyone should be able to make financial decisions with confidence.

- So the tax deadline for income earned in the fourth quarter of 2021 is Tuesday, Jan. 18, 2022.

- If you don’t pay enough tax through withholding and estimated tax payments, you may have to pay a penalty.

If their net earnings are above $400, an estimated tax must be paid on the entire amount. Individuals must still file a tax return even if they earned less than $400, as long as they meet certain eligibility requirements. You have special criteria to meet, but you may end up paying less in estimated taxes. You’re considered a qualified farmer or fisherman if you earn more than two thirds of your taxable gross income from farming or commercial fishing. If you’re an employee, your employer typically withholds taxes from every paycheck and sends the money to the IRS, and probably to your state government as well. And, if you’re like most wage earners, you get a nice refund at tax time.

Federal Income Tax Calculator: Return and Refund Estimator 2023-2024

Janet has been nominated as a top Woman in Accounting by Practice Ignition and honored as a Top 100 Innovative Women in Tax by Canopy Tax. Whatever amount you estimate you will owe for the year, you should pay it early in the year and get it out of the way. Consider 25% for the first payment and 50% for the second payment in order to have a large chunk of debt taken care of in advance, or ahead of a downturn in business. But you need to request an extension before your tax deadline. In some cases, however, individuals may be able to obtain certain waivers or exemptions to help lessen the blow of any penalties incurred by underpayment. Staying on top of your quarterly taxes can give you peace of mind—and save you money.

Find your tax liability

This year, I decided to start filing my taxes again on my own. As a result, I found out he had given me incorrect advice for all of these years regarding paying my estimated taxes. If you earned income in another state, you must report that amount on your Oklahoma return.

Do I Have to Pay Income Tax in Oklahoma?

- We’ll search over 500 deductions and credits so you don’t miss a thing.

- Pay close attention to those deadlines because making your estimated payments late can result in an underpayment penalty, even if you don’t owe any additional tax when you file your return.

- If you don’t pay enough tax by the due date of each of the payment periods, you may be charged a penalty even if you are due a refund when you file your income tax return.

- Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2023 tax return in 2024.

- According to the IRS, you don’t have to make estimated tax payments if you’re a U.S. citizen or resident alien who owed no taxes for the previous full tax year.

- Wage-earners and salaried employees can avoid estimated tax payments by having their employer withhold tax from their wages.

This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. WASHINGTON – The IRS encourages taxpayers to use the IRS Tax Withholding Estimator to ensure they’re withholding the correct amount of tax from their pay in 2024. My boyfriend believes I should not ask to be reimbursed because although his dad offered to do my taxes, he never charged me for the services rendered. Not once did he mention the penalty I owed and it’s not on any of the returns he gave me, after filing.

Ask Amy: My boyfriend’s dad messed up my taxes and I’m paying the penalties

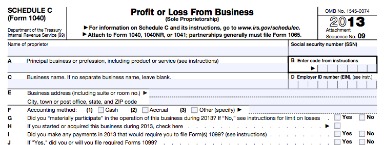

Then, based on its recommendations, they can use Form W-4, Employee’s Withholding Allowance Certificate, to tell their employer how much tax to withhold from their pay. Deductions are expenses that you’re allowed to deduct from your gross income, which is what you’ll find in box 1 of your W-2 form. IRS Form 1040-ES is used to calculate and pay estimated taxes for a given tax year. A taxpayer who had no tax liability for the prior year, was a U.S. citizen or resident for the whole year, and had the prior tax year cover a 12-month period, does not have to file Form 1040-ES. If you expect your income this year to be less than last year and you don’t want to pay more taxes than you think you will owe at year end, you can choose to pay 90 percent of your current year tax bill.

Exception to filing requirement

Unless the 15th falls on a weekend or federal holiday, in which case the due date becomes the first business day following the 15th. While not ideal, overpaying and receiving a refund is often preferable to underpaying and suffering penalties or interest. The IRS mandates employers to send 1099 forms to workers who are paid more than $600 during a tax year. John Waggoner covers all things financial for AARP, from budgeting and taxes to retirement planning and Social Security. Previously he was a reporter for Kiplinger’s Personal Finance and USA Today.

Other Deductions

We use this information in our tax return calculator to give you an accurate estimate of your return. Installments for estimated tax payments are due on April 15, June 15, and Sept. 15 of the same year and Jan. 15 of the following year. Everyone is required to pay the federal government taxes as they earn or as they receive income during the year. Estimated taxes may be made for any type of taxable income that is not subject to withholding. This includes earned income, dividend income, rental income, interest income, and capital gains.

How to Lower Your Effective Tax Rate

Tax Deadline Extended for San Diegans Following January Storms Cal OES News – Cal OES News

Tax Deadline Extended for San Diegans Following January Storms Cal OES News.

Posted: Fri, 12 Apr 2024 07:00:00 GMT [source]