QuickBooks Online offers a large selection of reports, but they aren’t industry-specific. With four plans, robust features and a user-friendly interface, QuickBooks Online is the ideal choice for most small businesses. QuickBooks Desktop, on the other hand, is a good option for businesses that prefer desktop software, need its advanced inventory tracking and reporting tools, or are looking for an industry-specific solution. When it comes to small business owners QuickBooks Online helps in achieving a much-needed peaceful environment for accounts management and filing their taxes. Local installations are billed annually, while hosted solutions are billed monthly. Its prominence also stems from its inclusion of tools its competitors lack, such as integrated advanced time tracking.

During QuickBooks Desktop and QuickBooks online provides contact management, only QuickBooks Desktop provides you better management of contacts and tracking leads. This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

A variety of short video tutorials are available as well as on-demand webinars and training classes. One of the best resources is the QuickBooks Online community, where you can connect with other users to share tips, answer questions, and find answers to problems that may arise. Product support can be accessed directly from within the application, where you can ask a question or connect to support personnel. QuickBooks Desktop also offers easy integration with QuickBooks Payments so you can accept online payments from customers. During the setup process, you can choose the features and functions that you will likely be using in QuickBooks Online.

QuickBooks Online VS QuickBooks Desktop Compare & Choose Which is Right?

If your office computer is a Mac, you can still use QuickBooks Desktop on your Mac. I do this using Parallels, software which allows you to run Windows applications on your Mac. You can, however, switch your business’s account from QuickBooks Difference Between Discount and Rebate with example Desktop to QuickBooks Online without losing your data. QuickBooks Desktop offers more than 100 standard reports that can be customized as needed. QuickBooks Online wins this one, offering easy system navigation from the user dashboard.

QuickBooks Online provides the advantage of accessibility, allowing you to manage your finances from anywhere with an internet connection. QuickBooks Desktop shines in terms of advanced functionality like inventory management and industry-specific features. QuickBooks Desktop also has additional features for customizing and exporting reports. These include the ability to track raw materials and finished products and automate order management, among other functions.

Whatever you want, our detailed feedback will help you make an educated choice when you’re looking for the right accounting program. But different applications may cause compatibility problems, particularly when you need to get financial details from several sources. Overall, QuickBooks Desktop is best suited for larger businesses with more complex accounting needs. If you are a small business owner with basic accounting needs, you may find that QuickBooks Online is a better fit. QuickBooks allows you to access almost all types of accounts, including but not limited to savings account, checking account, credit card accounts, and money market accounts.

How the Software Stacks Up

For an additional monthly fee, QuickBooks Online offers a virtual bookkeeping solution, which can be used to get help with setting up and managing your accounts. Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication. These versions give business owners more features and reports geared toward their industry. You can learn more in our guide to the industry-specific editions of QuickBooks Enterprise.

- QuickBooks allows you to access almost all types of accounts, including but not limited to savings account, checking account, credit card accounts, and money market accounts.

- QuickBooks online offers customers with much of the same excellent functionality when enjoying the mobility of cloud-based apps.

- The QuickBooks Online has primary options including international invoicing, mobile apps, and lending international invoicing.

- QuickBooks desktop provides the same service services seen in QuickBooks online, including video guides, on-demand webinars and a range of training options.

The QuickBooks Online is easier to learn and user-friendly than QuickBooks Desktop. QuickBooks desktop offers customers with some of the most sophisticated accounting resources on the market. The platform provides robust functionality, special features such as lead management and purchase orders, industry-specific software versions, and has the ability to be more reliable. QuickBooks Online offers four monthly plans for businesses, each with a specified number of users. QuickBooks Desktop, on the other hand, is available as an annual subscription — with an additional cost per user. QuickBooks Online has a 30-day free trial, while QuickBooks Desktop provides a 60-day money-back guarantee.QuickBooks Online’s pricing structure may be a better choice for you if you want a fixed monthly plan.

What QuickBooks Online offers

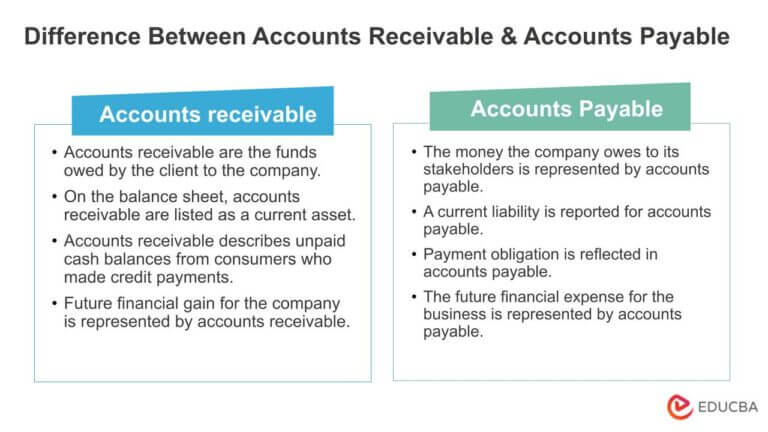

The monthly pricing structure operates better for small a business that does not have the cash flow for high-priced licensing or annual subscriptions. Both Intuit products use double-entry accounting protocols and having accrual & cash-basis accounting. Each system provides an in-depth chart of accounts, bank reconciliation, accounts receivable, journal entries, accounts payable, and the general reports required to run a company. Although QuickBooks Desktop is recognized as a better reporting system and helps in ease of managing complex tasks. One of the essential differences is QuickBooks Desktop is a license-based pricing structure whereas QuickBooks online has a monthly SaaS.

In the Delete process, select the file, lists, or transactions you want to delete, then apply the filters on the file and then click on the Delete option. To use the service, you have to open both the software QuickBooks and Dancing Numbers on your system. To import the data, you have to update the Dancing Numbers file and then map the fields and import it.

Vendor, customer, or employee details can be viewed by clicking on the appropriate tab, while transactions can be initiated by clicking on the corresponding icon. In addition to third-party integrations, QuickBooks Online integrates with native products, such as QuickBooks Payments, QuickBooks Payroll, and QuickBooks Time (formerly TSheets). QuickBooks Desktop can be integrated with QuickBooks Desktop Payroll and QuickBooks Time.

Only QuickBooks Desktop Offers…

Katana integrates with QuickBooks Online and equips you with all the necessary tools to manage your inventory and manufacturing processes. It also keeps all your information automatically synced across all your business tools, saving you precious time and eliminating human errors. Both platforms come with the basic features needed to manage your accounts, but there are certain differences between QuickBooks Desktop and Online. Let’s see how these two platforms compare in features, pricing, and reviews to help you decide on QuickBooks Online vs. Desktop in 2023.

Accounting

It’s ideal for businesses that can’t afford expensive annual subscriptions. QuickBooks Desktop Premier Plus and Enterprise plans have industry-specific reports for manufacturing and wholesale, retail, nonprofit, general contractor and professional service businesses, too. For example, nonprofits can use the desktop products to run donor contribution summary reports while manufacturing, wholesale and retail businesses have the ability to forecast product sales. Contractors and professional service businesses can use the software to compare revenue by city, customer and job type.

Both have a lot going for them, but there are some key differences between QuickBooks Desktop and Online. Find help articles, video tutorials, and connect with other businesses in our online community. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website.

The mobile app for Online is robust, and Desktop’s mobile app is so limited, that it essentially functions as a receipt uploader. Working from the cloud means you need an internet connection, so a poor signal or an intermittent connection can be an issue. Both QuickBooks online vs desktop are competent applications with efficient accounting features. QuickBooks online ranks a lot higher than QuickBooks desktop for Ease of Use with 4.25 points out of 5, relative to QuickBooks desktop’s poor ranking of 1.88 out of 5. This expensive arrangement often applies to add-ons, which come at their own expense. The process often affects simple features such as automatic data backups that enable you to restore your business to a previous point in time.

Accountants provide discovering QuickBooks pro and Premier to be more traditional to access, you don’t require becoming a professional bookkeeper or accountant to learn QuickBooks online. QuickBooks Pro does not provide the mobile applications being locally-installed system, the QuickBooks Online offer features advantageous with both Android and iOS apps. We are aware of a new lending service introduced in QuickBooks named QuickBooks Capital.

It is most commonly deployed as on-premise software, with one license accessible on one machine. This provides the highest level of security from hacking and fraud, but it does mean you won’t be sending invoices from your phone or tablet. QuickBooks Enterprise does sync with the cloud, but is accessed from your computer’s desktop and is available offline or behind a firewall.